Trying to pick between Motley Fool and Morningstar, but both look completely different?

One gives you stock picks, the other gives you deep research tools. And both claim to help you invest smarter.

This detailed breakdown will help you understand how they work, how they differ, and which one actually fits your investing style.

Scroll through this complete comparison to choose the right platform confidently.

1. What Are Motley Fool & Morningstar?

Both platforms help you make smarter investment decisions but in completely different ways. This section explains their core purpose so you quickly understand what each service truly offers.

🌱 Motley Fool – Stock Picks for Everyday Investors

Motley Fool is best described as an action-oriented investing service. Instead of overwhelming you with data, it gives you:

- Specific stocks to buy

- Reasoning behind each pick

- Long-term investment philosophy

- Investor-friendly explanations

- Monthly buy alerts

Think of Motley Fool like having a friend who tells you which stocks look promising, explains why, and reminds you to look beyond short-term noise.

It’s simple, direct, and perfect for people who want “tell me what to buy” guidance.

🔬 Morningstar – Research Tools Used by Professionals

Morningstar is the opposite. It doesn’t give you monthly picks. Instead, it gives you:

- Independent investment ratings

- In-depth stock, ETF, and mutual fund reports

- Portfolio analysis tools (like X-Ray)

- Historical performance data

- Risk analysis & asset allocation breakdown

Morningstar is like having a research lab in your pocket ideal if you want to understand every angle before investing.

2. Key Differences Explained

Motley Fool focuses on simple stock picks, while Morningstar provides deep research tools. These differences help you decide which platform matches your investing style.

🎯 1. Purpose

Motley Fool focuses on giving you ready-to-use stock picks, so you can invest without doing heavy research.

Morningstar provides deep research, ratings, and analysis tools, helping you make your own informed decisions.

🧠 2. Ideal Investor

Motley Fool is perfect for beginners or busy investors who want clear guidance and quick action.

Morningstar suits serious, detail-oriented investors who like studying data before choosing investments.

📊 3. Investment Coverage

Motley Fool mainly targets U.S. growth stocks and doesn’t focus much on funds or ETFs.

Morningstar covers everything stocks, ETFs, index funds, mutual funds, and full portfolio breakdowns.

🧭 4. Decision Style

With Motley Fool, you simply follow expert stock recommendations each month.

With Morningstar, you use their tools and research to build and analyze your own investment strategy.

🔥 5. Approach

Motley Fool follows a long-term, buy-and-hold strategy focused on high-growth companies.

Morningstar offers flexible analysis, ideal for evaluating both short-term and long-term investment options.

🛠️ 6. Tools & Technology

Motley Fool keeps tools simple mainly stock picks, reasons, and basic performance insights.

Morningstar provides advanced tools like Portfolio X-Ray, fund ratings, risk analysis, and deep reports.

3. Features & Tools Comparison

Motley Fool and Morningstar both offer powerful features but they are built for completely different types of investors. Below is a detailed breakdown so readers instantly understand what they actually get with each platform. ⚙️

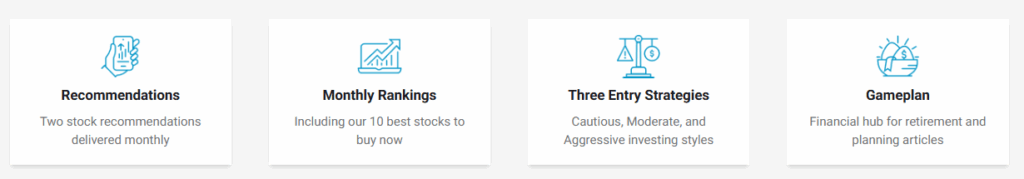

⭐ Motley Fool — Features Explained in Detail

1. Monthly Stock Picks

Motley Fool’s signature feature is its 2 monthly stock recommendations, backed by research and long-term conviction.

They explain why each company was selected, what makes it promising, and how it fits into current market trends.

2. “Best Buys Now” List

This is a curated list of stocks the analysts believe are the most attractive right now.

It helps investors with limited time quickly find strong opportunities without scanning the full market.

3. Company Research & Easy Explanations

Every pick comes with simple breakdowns of:

- Business model

- Growth potential

- Risks

- Long-term outlook

These summaries are beginner-friendly and eliminate research overwhelm.

4. Model Portfolios

Motley Fool includes sample portfolios based on different strategies.

This helps new investors follow proven patterns or build confidence if they’re unsure where to start.

5. Educational Resources

The platform offers guides, training articles, and beginner investing lessons.

This is especially helpful for new investors who need direction before building their first portfolio.

6. Community Access

Members can access discussion boards with experienced investors.

It’s great for learning from others, asking questions, and getting reassurance about long-term strategies.

⭐ Morningstar — Features Explained in Detail

1. Morningstar Star Ratings (Funds & ETFs)

Morningstar’s iconic 1–5 star ratings evaluate mutual funds and ETFs using risk-adjusted performance.

This helps investors quickly compare fund quality, costs, and reliability.

2. Analyst Ratings & Reports

Morningstar provides in-depth analyst research for stocks, ETFs, and funds — including fair value estimates, risk analysis, and competitive advantage breakdowns.

This is perfect for investors who want professional-level insights.

3. Portfolio X-Ray Tool

This tool shows your full portfolio breakdown, including sector exposure, diversification, overlap, and overall risk.

4. Investment Screener Tools

You can filter thousands of investments based on returns, fees, risk, or valuation to find the best opportunities.

5. Performance & Risk Charts

You get detailed visuals showing long-term performance, volatility, expense ratios, and category ranking.

This level of detail is ideal for investors who want clarity before committing money.

6. Fund Comparisons & Benchmarks

You can compare multiple funds side by side to see which offers better long-term consistency.

This feature is extremely valuable for retirement investors building a diversified portfolio.

7. Extensive Database

The platform covers stocks, ETFs, mutual funds, index funds, and global markets — giving you a complete research library.

🔍 Side-by-Side Feature Comparison Table

| Feature | Motley Fool | Morningstar |

|---|---|---|

| Stock Picks | ✔ Monthly picks | ❌ No picks |

| Fund & ETF Coverage | Limited | ✔ Extensive |

| Portfolio Tools | Basic model portfolios | ✔ Advanced (X-Ray, risk, allocation) |

| Research Depth | Medium | ✔ Very deep |

| Screener Tools | ❌ Not available | ✔ Yes |

| Analyst Reports | Basic commentary | ✔ Professional-grade |

| User Skill Level | Beginner-friendly | Intermediate–Advanced |

| Investment Style | Long-term stock growth | Comprehensive portfolio planning |

4. Pricing Breakdown

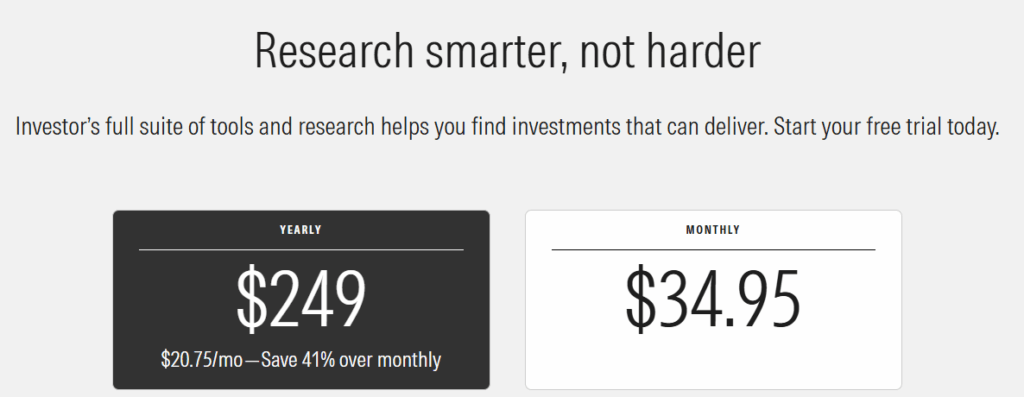

🟦 Morningstar Investor Pricing

• Yearly Plan: $249/year

You pay $20.75/month (billed annually) and save 41% compared to monthly billing. Best for long-term users who want full access to Morningstar’s research tools.

• Monthly Plan: $34.95/month

Good if you prefer flexibility or want to try the platform without committing to a full year.

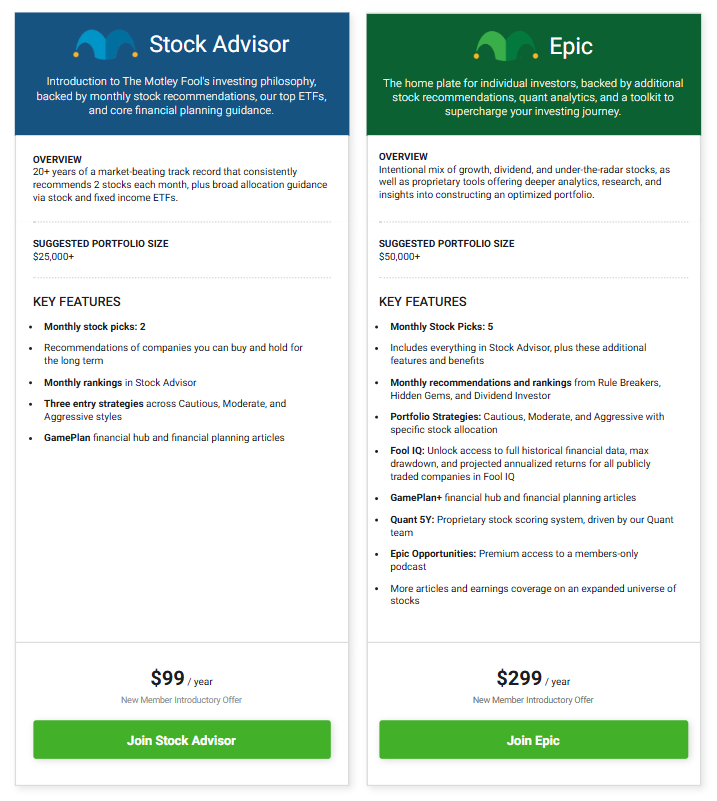

🟩 Motley Fool Stock Advisor Pricing

• $99/year (Introductory Offer)

Includes 2 new stock picks every month, rankings, ETF allocation guidance, investment strategies, and educational articles. This is the most popular and beginner-friendly Motley Fool plan.

🟧 Motley Fool Epic Plan Pricing

• $299/year (Introductory Offer)

You get 5 monthly stock picks, access to multiple newsletters (Rule Breakers, Hidden Gems, Dividend Investor), quant-driven tools, Fool IQ data, portfolio strategies, and deeper research coverage.

Ideal for investors wanting broader stock coverage + advanced research.

📈 5. Performance & Track Record

Understanding how each service performs is important but Motley Fool and Morningstar measure “performance” in two totally different ways. One focuses on stock picks, the other on research accuracy. Here’s the breakdown:

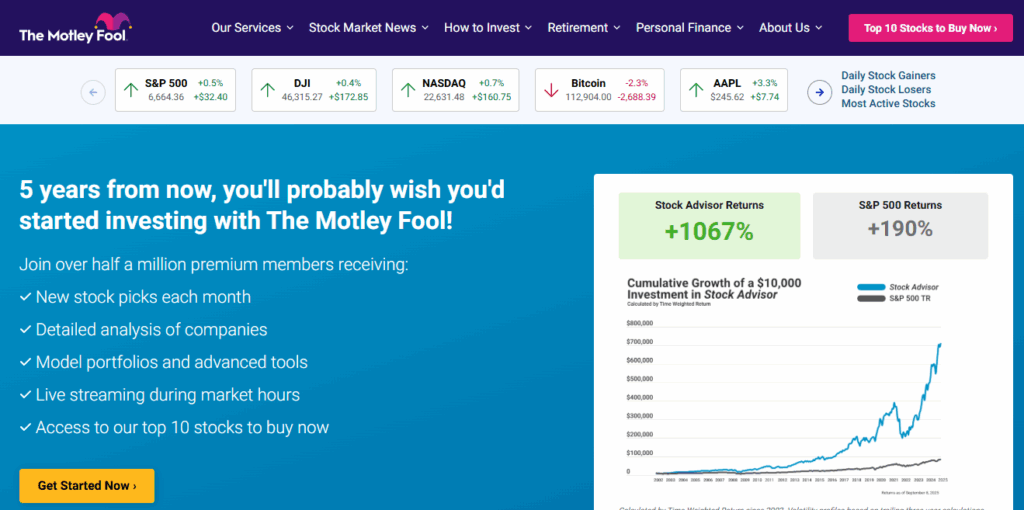

A. Motley Fool Performance (Stock Picks Track Record)

Motley Fool’s performance is based on how well their stock recommendations have done over time.

Here’s what stands out:

✔ 1. Historically Outperformed the Market

Motley Fool’s flagship service, Stock Advisor, has delivered returns much higher than the S&P 500 over 20+ years mainly due to early picks like Amazon, Tesla, Nvidia, and Netflix.

✔ 2. Focus on Long-Term Growth

Their philosophy works best when you hold picks for 3–5+ years, allowing high-growth companies to compound.

Short-term volatility is common, but long-term gains are often strong.

✔ 3. Not All Picks Win

Even though the average performance is high, some picks drop heavily.

Their strategy relies on a few big winners offsetting several losers.

B. Morningstar Performance (Research Accuracy & Ratings)

Morningstar doesn’t give stock picks, so their performance is measured differently:

✔ 1. Strong Reputation for Fund Ratings

Morningstar’s star rating system is one of the most trusted tools for evaluating mutual funds and ETFs.

Highly rated funds often show better risk-adjusted returns, especially for long-term investors.

✔ 2. Research Quality Over Returns

Morningstar’s value comes from its deep analysis, not specific investment calls.

Its reports help investors understand risk, performance history, fees, and overall portfolio strength.

✔ 3. Ratings Don’t Guarantee Future Results

Morningstar ratings are helpful, but they’re not predictions.

A 5-star fund isn’t guaranteed to outperform it simply means the fund performed well historically relative to peers.

🖥️ 6. Ease of Use & User Experience

🌿 Motley Fool

Motley Fool is extremely easy to use, with a simple dashboard that highlights only what you need: monthly picks and quick explanations.

It’s perfect for beginners or busy investors who want fast guidance without digging into charts or data.

🧩 Morningstar

Morningstar is powerful but more complex, offering deep research tools, ratings, and advanced portfolio analysis.

It suits analytical investors who enjoy studying data and don’t mind a steeper learning curve.

🎯 7. Who Should Use Which?

⭐ Motley Fool — Best For

- Investors who want clear, ready-to-buy stock picks.

- Beginners who prefer simple guidance over complex research.

- Busy people who don’t have time for deep analysis.

- Long-term investors who like following expert recommendations.

⭐ Morningstar — Best For

- Investors who want professional-level research and tools.

- People who enjoy studying risk, performance, and portfolio allocation.

- ETF and mutual fund investors who need detailed comparison data.

- Hands-on investors who prefer to make decisions using in-depth analysis.

⚖️ 8. Pros & Cons

A. Motley Fool : Pros and Cons

Pros

- Easy to follow: Stock picks are simple, beginner-friendly, and require no deep research.

- Strong long-term returns: Many past recommendations have outperformed the market.

- Low time commitment: Just check monthly picks and hold long-term.

- Affordable pricing: Lower cost compared to most research platforms.

Cons

- Limited tools: No advanced portfolio analysis or deep charts.

- Stock-only focus: Weak for ETF or mutual fund investors.

- Volatile picks: Growth stocks can swing heavily in the short term.

B. Morningstar : Pros and Cons

Pros

- Professional-grade research: Detailed reports, ratings, and analyst insights.

- Best for funds & ETFs: Industry-leading evaluation tools for diversified portfolios.

- Portfolio X-Ray: Helps you analyze allocation, overlap, risk, and performance.

- Great for long-term planners: Perfect for investors wanting a data-backed strategy.

Cons

- Higher price: Costs more than Motley Fool for full access.

- More complex: Not ideal for beginners or casual investors.

- No stock picks: You must analyze and choose investments yourself.

🏁 9. Final Verdict

Choosing between Motley Fool and Morningstar depends entirely on how you prefer to invest and what level of guidance you want.

⭐ Motley Fool is the Better Choice If:

You want simple, actionable stock picks without doing heavy research.

It’s perfect for beginners, busy investors, or anyone who wants to follow a proven long-term strategy with minimal effort.

⭐ Morningstar is the Better Choice If:

You prefer deep research, full portfolio analysis, and detailed data across stocks, ETFs, and mutual funds.

It’s ideal for hands-on investors who enjoy comparing risk, performance, and asset allocation before buying.

🧠 Final Insight

- Choose Motley Fool if you want: “Tell me which stocks to buy.”

- Choose Morningstar if you want: “Give me the data so I can decide myself.”

Both are strong platforms but they serve two completely different investing personalities.

“RELATED ARTICLES”

❓ 10. FAQs

1️⃣ Does Morningstar give stock picks like Motley Fool?

No. Morningstar focuses on research, ratings, and analysis tools. It does not provide “buy this stock now” recommendations like Motley Fool.

2️⃣ Which one is better for beginners?

Motley Fool. Its simple stock picks and easy explanations make it ideal for new or casual investors who don’t want complex data.

3️⃣ Which platform is better for ETFs and mutual funds?

Morningstar. It provides industry-leading fund ratings, in-depth analysis, and tools for comparing costs, performance, and risk.

4️⃣ Is Motley Fool reliable for long-term returns?

Yes, historically many Motley Fool stock picks have outperformed the market but results vary, and long-term holding is essential.

5️⃣ Can I use both services together?

Absolutely. Many investors use Motley Fool for ideas and Morningstar for analysis, creating a balanced and informed investing system.