If you’re searching for Motley Fool Stock Advisor pricing, you’ve probably noticed how confusing all the different plans can get.

Stock Advisor, Epic, Epic Plus, Fool One each one promises more picks, more tools, and more “exclusive insights”… but what does all of that actually mean for your money? 🤔

Don’t worry I’ve broken everything down clearly, simply, and with real data (from the screenshots you shared).

Whether you’re a beginner building your first portfolio or an investor improving your strategy, this guide helps you pick the plan that gives maximum value for your budget.

Let’s make this easy. 👇

1️⃣ What Is Motley Fool Stock Advisor?

Stock Advisor is Motley Fool’s most popular and affordable investing service. Think of it as your monthly stock-pick newsletter but with research, rankings, guidance, and strategies built on more than 20 years of market performance.

You get:

- ✔️ 2 carefully researched stock picks per month

- ✔️ Long-term holding guidance

- ✔️ Rankings of top stocks

- ✔️ Foundational stocks list for stable portfolios

It’s specifically made for normal people (not Wall Street pros) looking to grow wealth slowly and safely.

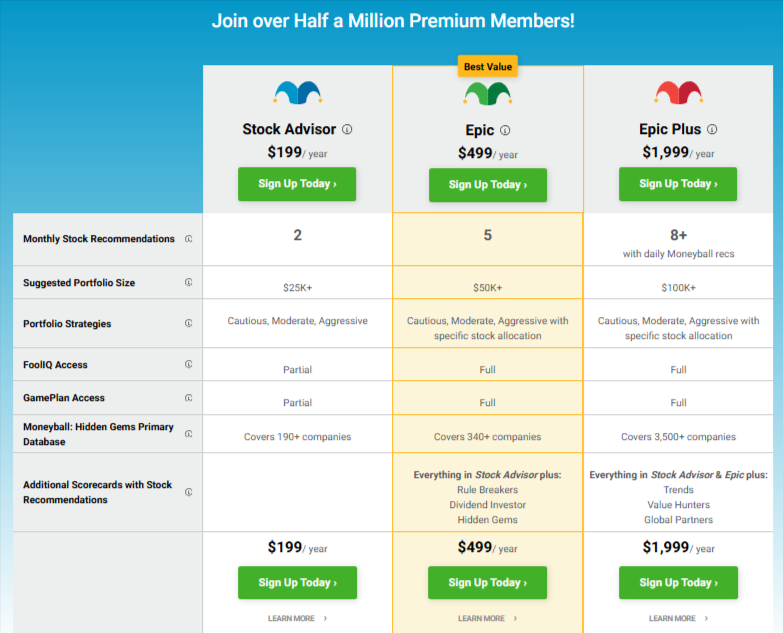

2️⃣ Motley Fool Pricing Overview (2025) 💵

Here’s the quick pricing summary:

| Motley Fool Plan | Annual Price |

|---|---|

| Stock Advisor | $199/year |

| Epic | $499/year |

| Epic Plus | $1,999/year |

| Fool One | $13,999/year |

| Individual Stock Reports | $100/report |

3️⃣ Motley Fool Stock Advisor Pricing & Features ($199/year) ⭐

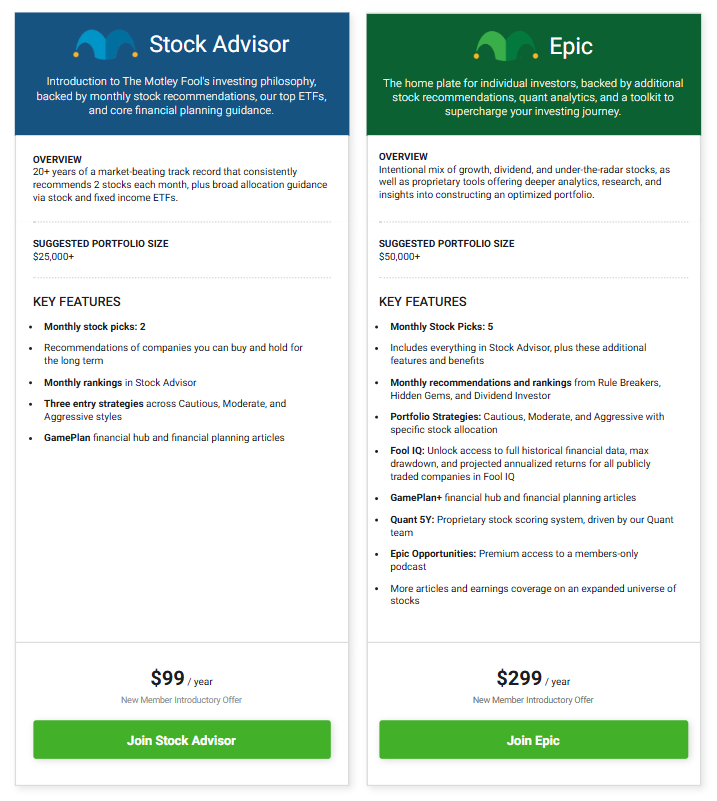

💰 Price: $199/year

The most affordable and beginner-friendly plan.

⭐ What You Get:

- 🟢 2 premium stock picks every month

- 🟢 Suggested portfolio size: $25,000+

- 🟢 Monthly stock rankings (helps you decide priority picks)

- 🟢 Foundational stocks list for stability

- 🟢 “My Stocks” portfolio tracking

- 🟢 Partial FoolIQ access

- 🟢 Partial GamePlan access

If you’re just starting out, this plan gives you exactly what you need actionable picks, simple explanations, and a roadmap. No overwhelm. No noise. Lots of value.

🎯 Best For:

→ Beginners

→ Long-term investors

→ People wanting simple, proven stock selections

4️⃣ Motley Fool Epic Pricing & Features ($499/year) 🚀

💰 Price: $499/year

Their highest value-for-money plan.

⭐ What You Get :

- 🔵 5 stock picks every month (vs 2 in Stock Advisor)

- 🔵 Suggested portfolio size: $50,000+

- 🔵 Everything in Stock Advisor PLUS…

- 🔵 Access to Rule Breakers, Hidden Gems & Dividend Investor insights

- 🔵 Portfolio strategies for cautious → aggressive investors

- 🔵 Full access to FoolIQ (deep research tools)

- 🔵 Full access to GamePlan

- 🔵 Coverage of 340+ companies

- 🔵 Quant analytics & deeper data tools

Epic feels like the “smart upgrade.” You go from basic picks to premium research, more stock choices, and tool access that actually helps you understand why a stock is being recommended.

This is the plan most serious investors end up sticking with.

🎯 Best For:

→ Investors wanting more than 2 picks

→ People who like data + research tools

→ Users with medium-size portfolios

5️⃣ Motley Fool Epic Plus Pricing & Features ($1,999/year) 💼🔥

💰 Price: $1,999/year

A premium plan for investors who want deep insights + high volume ideas.

⭐ What You Get:

- 🟣 8+ stock picks per month

- 🟣 Daily stock ideas from Moneyball Portfolio

- 🟣 Everything in Stock Advisor + Epic

- 🟣 Coverage of 3,500+ companies

- 🟣 Access to advanced tools like:

- AI Playbook Portfolio

- Options trading strategies

- Moneymakers Portfolios

- Expanded quant analytics

- 🟣 Additional scorecards and research

If you’re someone who checks the market daily, loves analysis, and wants constant actionable recommendations, Epic Plus gives you the firehose.

🎯 Best For:

→ Active traders

→ High-confidence long-term investors

→ Large portfolio owners

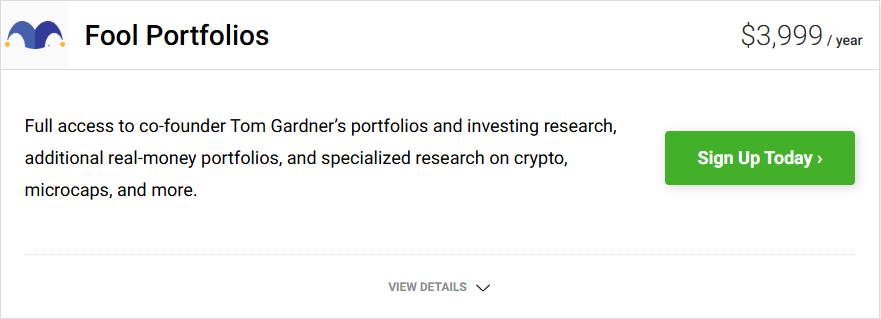

6️⃣ Fool Portfolios Pricing ($3,999/year) 📊🔍

💰 Price: $3,999/year

A premium plan designed for investors who want professionally managed, real-money portfolio guidance.

⭐ What You Get:

✔️ Access to Tom Gardner’s real-money portfolios

✔️ Advanced research on crypto, microcaps, and niche sectors

✔️ Multiple expert-built portfolios to follow

✔️ Exclusive buy/sell updates and performance alerts

✔️ Access to premium tools for portfolio analysis

Fool Portfolios gives you a direct window into how Motley Fool’s co-founder invests real money. Instead of monthly picks, you get complete, ready-made portfolios with expert reasoning behind every move. Perfect for investors who want deeper guidance than Stock Advisor or Epic.

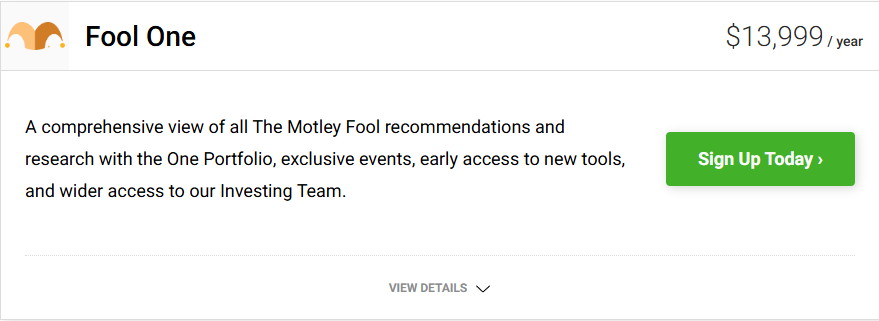

7️⃣ Fool One Pricing ($13,999/year) 🏆🚪

💰 Price: $13,999/year

This is Motley Fool’s highest-level membership, built for investors who want complete access to every premium tool, pick, and portfolio they offer.

⭐ What You Get:

- ✔️ Access to EVERY Motley Fool recommendation

- ✔️ VIP-level tools, events, and analysis

- ✔️ One Portfolio access (guided master portfolio)

- ✔️ Early access to new research

- ✔️ Priority communication with the investing team

This is Motley Fool’s “all-access backstage pass.” It’s designed for high-net-worth investors who want everything under one roof.

8️⃣ Individual Motley Fool Reports ($100/report) 📄

💰 Price: $100 per report

These reports include:

- 🔍 1 Top Motley Fool Stock

- 🔍 1 Stock Recommended by Stock Advisor

Perfect for people who don’t want a full membership.

9️⃣ Stock Advisor vs Epic vs Epic Plus (Comparison Table)

| Feature | Stock Advisor ($199) | Epic ($499) | Epic Plus ($1,999) |

|---|---|---|---|

| Monthly Picks | 2 | 5 | 8+ |

| Moneyball Access | 190+ companies | 340+ companies | 3,500+ companies |

| FoolIQ Tools | Partial | Full | Full |

| Portfolio Guidance | Basic | Advanced | Premium |

| Best For | Beginners | Serious investors | High-volume investors |

🔟 Which Motley Fool Plan Should You Choose? 🤔

✔️ Choose Stock Advisor

If you’re a beginner or investing a smaller amount. Simple, affordable, and easy to follow.

✔️ Choose Epic

If you want more monthly stock picks and deeper research without spending too much.

✔️ Choose Epic Plus

If you’re an active investor with a larger portfolio and want daily ideas + advanced tools.

✔️ Choose Fool Portfolios

If you want to follow real-money portfolios built by Motley Fool experts.

✔️ Choose Fool One

If you want full access to every Motley Fool service their top-tier, all-in membership.

1️⃣1️⃣ Pros and Cons

👍 Pros

- Easy-to-understand picks

- Long-term proven performance

- Beginner-friendly

- Deeper research available in higher tiers

- Transparent pricing

👎 Cons

- Some plans get expensive

- Not ideal for short-term trading

- Higher-tier tools can feel overwhelming

- Daily picks may tempt overtrading

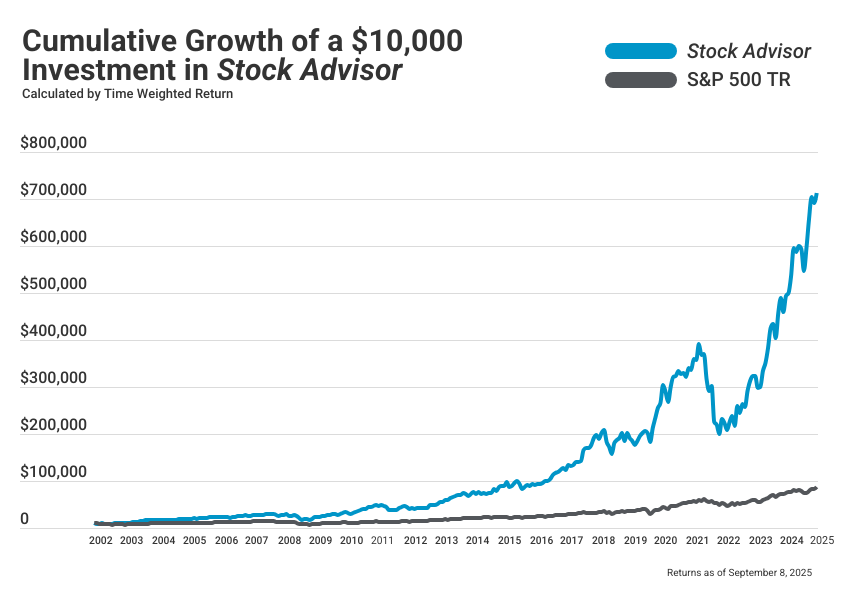

Stock Advisor Historical Performance

Motley Fool Stock Advisor has built its reputation on one thing: long-term market outperformance. Since launching in 2002, many of its early and mid-2000s stock recommendations — like Amazon, Netflix, Nvidia, Tesla, Shopify, and MercadoLibre — grew into massive winners over the next decade.

The service doesn’t promise quick gains. Instead, Stock Advisor focuses on strong companies with long-term potential, and the strategy historically works best when you hold picks for 5+ years.

While not every recommendation becomes a winner, the overall portfolio strategy has beaten the S&P 500 by a wide margin over long periods.

Stock Advisor’s performance highlights:

- 🚀 Focus on high-quality growth companies

- 📅 Long-term holds (not day trading)

- 📈 Historically strong return compared to the general market

- 🎯 Clear guidance on when to buy, hold, or revisit picks

This is one of the main reasons investors trust Stock Advisor the track record shows that even a few big winners can make a significant difference in total returns when following the strategy consistently.

⚠️ Who Stock Advisor Is NOT For

Even though Motley Fool Stock Advisor is one of the most popular investing services, it’s not the right fit for everyone. Here’s who should avoid it:

❌ 1. Short-term traders

If you want fast profits, daily trading signals, or short-term flips, Stock Advisor won’t help. Their picks are designed to be held for 3–5+ years, not days or weeks.

❌ 2. People who panic when prices drop

Stock Advisor often recommends growth stocks that can be volatile. If you can’t handle temporary dips, this service may feel stressful.

❌ 3. Investors with very small budgets

If you’re investing less than $500–$1,000 total, the annual fee may not feel worth it yet. Better to build savings first.

❌ 4. Anyone expecting guaranteed results

No stock-picking service can guarantee profits. Stock Advisor works best for investors who understand risk and patience.

❌ 5. People who won’t follow long-term strategy

This service is built around buying and holding high-quality companies long-term. If you don’t follow that approach, you won’t see the real benefits.

🏁 Final Conclusion

Choosing the right Motley Fool plan depends completely on how you like to invest. If you want something simple and affordable, Stock Advisor gives unbelievable value for just $199/year.

If you want deeper insights, more picks, and long-term strategies that feel “pro-level,” Epic is the clear winner for most investors.

Epic Plus and Fool One are powerful upgrades but only worth it if you’re handling larger portfolios or want constant daily stock ideas.

No matter what you choose, Motley Fool has a proven track record of helping investors grow wealth with long-term, research-backed guidance. 📈💡

“RELATED ARTICLES”

FAQs

1. Is Motley Fool Stock Advisor worth the price?

Yes – at $199/year, it’s one of the highest-value beginner investing memberships.

2. What is the best Motley Fool plan for most people?

Epic ($499) – best mix of cost, features, and premium insights.

3. Are there discounts?

Yes, but they vary. Stock Advisor often gets promotional offers.

4. Do plans renew automatically?

Yes, unless turned off in your account.

5. Can beginners use Motley Fool?

Absolutely – it’s designed for long-term, everyday investors.